How Types of Credit Affect Your Credit Scores

It’s important to build credit by successfully managing both revolving and installment credit accounts. When you pay off an installment loan, it reduces your credit mix, which can technically hurt your credit score. In this type of scenario, you’ll have to take into account how important the state of your credit mix is compared to the rate of interest you’re paying on your installment loan. A credit card account, on the other hand, is a revolving account, a line of credit you have access to without a fixed monthly payment. Your balance determines your minimum payment and there is no set end date to your agreement.

How often should you apply for a credit card?

In fact, having too many credit cards can potentially lower your credit score if you’re not using them responsibly or if you’re carrying high balances. What this shows lenders is that you have a mix of credit, including both revolving and installment credit. Having a blend of the two (and, of course, making timely payments on them) is ideal for maintaining the best possible credit score.

- The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews.

- Offer pros and cons are determined by our editorial team, based on independent research.

- The information, including card rates and fees, presented in the review is accurate as of the date of the review.

- It isn’t just the number of each type of account you have, but how each account relates to others among all categories, and how they interrelate with the other score factors.

Should You Pay for Credit Repair Services?

So do strive for a good credit mix to bolster your credit score, but don’t apply for loans you don’t need because you’re worried about your credit mix. The impact of opening new credit on a credit score will vary from person to person. Taking out an auto loan, for example, might have a greater effect on your credit score than someone else’s, depending on your financial scenarios.

How to Improve Your Credit Mix

💡To improve your credit mix, start by assessing the credit lines you already have open. So, while it’s important to consider your credit mix, keep in mind that a diverse credit mix may do more harm than good if you don’t manage your debt well. A positive history of on-time payments is considered the most important credit-scoring factor. Whether you’re working to build your credit score or maintain a good credit score, it’s important to monitor your credit regularly. With Experian, you can check your FICO® Score and Experian credit report for free anytime.

How much does credit mix impact your overall credit score?

These cards look and feel like credit cards, but you have to pay the balance in full by the end of each month. Some American Express cards are examples of charge cards, as opposed to credit cards. The offers that appear on this site are from companies that compensate us. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you. For those who are new to credit cards, consider opening one to have some form of revolving credit and use it wisely — only charge what you know you can pay off in full by the due date.

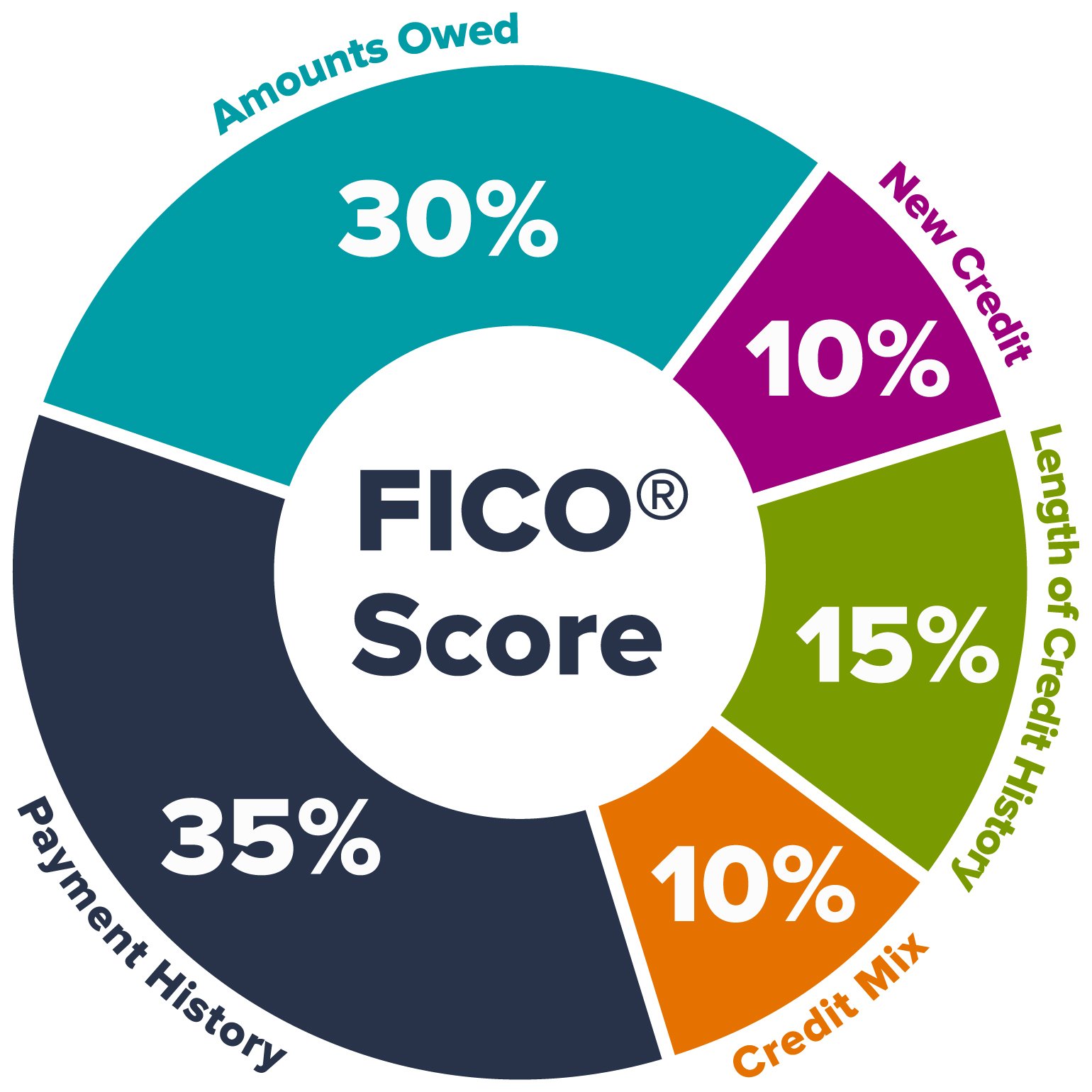

What’s in my FICO® Scores?

You should also be aware that while being added as an authorized user on someone else’s credit card can help, having a card in your own name is given much more weight in credit score calculations. If you have a thin credit file you may have a low credit score even if you have made payments regularly. how does credit mix affect credit score You may not have enough information in your file to generate a score. If you are just starting to build credit, then you may have a thin credit file. This is a credit report that only contains a small number of open accounts that have only been reporting for a short period of time.

Having a diverse credit mix can showcase your ability to handle different kinds of financial responsibilities, which ultimately works in your favor to boost your credit score. So, whether you’re a student just starting to build credit or a seasoned borrower looking to improve your credit score, consider diversifying your credit mix to achieve better financial health. The steps you take to improve your credit score will depend on your unique credit profile. In general, it’s important to understand the factors that influence your score, including your payment history, amounts owed, length of credit history, credit mix and new credit. Credit scoring systems comb and analyze credit reports to evaluate how you manage credit.

Your credit score will benefit most when you have a healthy “mix” of both types, revolving and installment. According to Experian, demonstrating your ability to manage different types of debt may come easier than you think. To use revolving credit, open a credit card and only charge what you know you can pay off in full by the due date. For installment credit, you may be surprised to find out that your car payment, mortgage or student loans already count as this type of credit account.

Improving your credit mix is straightforward, but you could experience some bumps in the road. If you wanted to close the account because of hefty fees, it might be better to first see if you can move your account to a different card that doesn’t have fees. Credit mix is one of the five factors that help determine your FICO® Score☉ , making up 10% of your score. How credit diversity influences your scores depends on your unique track record with credit. Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website.

Success comes from consistent good habits and understanding how credit scoring works. With these strategies, you can take control of your credit score and build a strong financial future. Using your credit card for manageable, everyday expenses, like groceries or bills, can build credit without adding debt. Credit report errors, like incorrect payment histories or duplicate accounts, can hurt your score. Review your report regularly and dispute any errors to keep your information accurate.